Our 2019 chart that calls the oil short for 2020

How did we make the call on oil?

This page outlines the course of events leading up to the crash in the oil price and paints a picture of how, utilising HVF Method on macro time-frames, we are able to accurately scenariocast when the crash may occur and specific target levels projected into the future.

It is almost uncanny how HVF Method is able to map out events and “coincidences” with macro economic and political events. Explore the timeline below to see how the story unfolded.

A prelude to the Oil crash. Our bias to bear on energies

Signs already showing. In the YouTube below we set the scene and reasoning for our bearishness on the energies discussing oil, gas.

PAA showing signs of weakness

Plains All-American (PAA) is a pipeline company engaged in moving and storing oil and other petroleum related materials.

Speculative trade entered on what we call an Early Entry (Advanced HVF Method) on structure that indicates weakeness and a possible fall in PAA price may be imminent.

Bear in mind this is almost one year ahead of the actual oil crash.

RRR tool shows a potential 83.54 on this speculative entry.

PAA (Daily)

My personal, speculative Early Entry for PAA on a spread-betting account at 25.824 with a stop at an HVF Method-derived value of 27.764

CCL trade

Auxilliary trades related to oil showing weakness.

Carnival Cruise Line (CCL) had been forming an iHVF over the past six months pointing to a possible spill from around mid-June to July 2019 based on oil’s macro signs of weakness.

CCL (4H)

Spilla-Thrilla

CCL triggers right on time and fell hard.

Subsequent strong recovery but did not invalidate the setup.

Eventually it made it’s HVF Method-derived and pre-determined target of $30.91

Plains All American Pipeline PAA, For whom the Grandfather clock tolls CCL, WFC Update

Aramco IPO or "Citizen bag holder stuffing"

Aramco had their IPO approved on the 3 November 2019.

Later in the month there was a harsh sell off which we called out describing it as a citizen bag holder stuffing.

YeahuUP.. the Oil Thang. $CL_F. Brent WTI & #Aramco citizen bag holder stuffing, Post IPO new lows me thinks. pic.twitter.com/kBLinb8O7H

— TheMarketSniper – MBA, CMT, Trader, Teacher & TA (@themarketsniper) November 29, 2019

Premium Community enters PAA and CCL shorts

Our Premium Community gets first dibs on any trade ideas. Those in the Community who elected to participate in this trade were already positioned and in the trade before we went public with our short calls on PAA and CCL.

PAA (1W)

CCL (2D)

See our video below for the public call on PAA

US Indices Higher on Tech Big Data Thieves, PAA, CCL, USDKRW, China A50

Public call on oil to single digits, Anarcapulco, 12 February 2020

The news before the news with HVF Method

At Anarcapulco 2020 we made our public call of the potential of a major crash in the oil price to single digits. PPI were underpricing for single digit oil.

Entry:

Stop:

Take profit target:

The presentation at Anarchapulco 2020 where the oil crash was publically called.

The news before the news: Oil 2020 12th of February

Oil gaps down $9.50 on open

Oil gapped down on open with Brent falling 25% on a Russian and Saudi oil glut. Supply over demand sees the price plummet.

USD/WTI CRUDE OIL (1H)

The chart below illustrates the break of key HVF-specific technical structures at the time of oils stab down on the 8th of March 2020.

Our YouTube livestream on the night of 8 March 2020 when oil gapped down on open.

Oil Gaps $9.5 Dollars in Russia/Saudi Glut

OIL CRASH TARGET

Was a date for target met?

Need chart for target made

Post oil crash - Reset season is in

The Greatest “Coincidence”

Post crash synopsis and the implications. We setting the stage for an incoming currency crisis waiting in the wings which subsequently transpired.

The Reset season is in.. Here is the real news before the news

PAA short closed with 30.9 RRR. TLW trade closed

Our PAA trade ws closed at the pre-determined target of $3.19 with a great Risk Reward Ratio of 30.9 on an early entry 24.50. Early entries to trades are an advanced technique with the HVF Method. A more speculative entry at $25 could have even squeezed a ridiculous 100+ RRR.

PAA trade details:

Stop at 25.26

Take profit: 3.19

RRR: 30.9

87.25% market cap decimation

HVF Method can also give you a second chance on a trade idea. The PAA trade allowed for a second chance entry at $19.34 which would have still reaped a 2.75 RRR, or with some judicious stop placement could have seen a 4.61 RRR.

PAA (1W) target made

PAA – Plains All American Pipeline, 82,5% MC short closed

Tullow Oil (TLW) Single digit target attained

The multinational oil and gas exploration company hits single digits and our pre-determined price target £10.086

TLW trade details:

Stop: 2.506

Entry: 1.967

Target: 1.067

RRR: 1.67

TLW (2D) target made

Tullow Plc, TLW – Short to Single digit home & Hosed

Is now the time to buy?

An over reaction in price action to downside usually manifests an equal and opposite reaction to the upside. This presented a good opportunity to buy into oil.

Our Falling Wedge structure from 18 September 2019 scenariocast the potential to go long after a fall in the price of oil for which the subsequent reversal played out.

The Great Oil ‘Rig’, Is now the time to Buy Oil – From Mr Oil Short at $64

Epilogue - What was Gold doing during the oil crash?

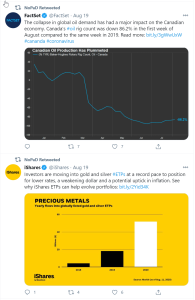

As oil production plummeted in August of 2020, investors moved quickly into the safe haven of gold and silver as a hedge against a potential increase in inflation and a weaker Dollar. Canada’s oil rig count down over 86%!

In the months oil had been plotting structure for its future crash, gold had been setting up tradable upside structures which reinforced and validated our scenariocast for oil and call for short oil long gold.

Gold/Oil (1W) setting up structure for an upside move prior to the oil crash.

Gold/Oil (1W) post the break saw extreme Overperformance well past our target levels.

Next big call - three-digit oil?

After a fall from 60’s to single digits, now calling for three-digit oil?

We now pivot to a macro time frame bull, especially on energies as well as commodities generally. At the time, this was on the back of a possible bond market top, debt market downturn and a possible series of interest rate hikes, all due to the lack of sound money.

The oil price structure played out as we had drawn our scenariocast from September 2019 with a move looking to break an almost two decade Falling Wedge with high momentum in one of the most inflationary environments that exists.

Oil for 3 digits coming sooner than you Think? Energy Market Dive